2022 annual gift tax exclusion amount

Noncitizen spouse annual gift exclusion. A separate annual tax exemption for gifts to non-citizens is increased to 164000.

The amount an individual can gift to any person without filing a gift tax return has remained at 15000 since 2018.

. Any person who gives away. If the gifts are made via trust the trust must be written to include a Crummey withdrawal power to qualify as a present interest gift for the annual exclusion. This is of particular interest to families with special needs because the ABLE contribution cap is tied to the annual gift tax exclusion meaning that the.

Outright gifts to recipients qualify for the annual exclusion. The annual exclusion for gifts is 11000 2004-2005 12000 2006-2008 13000 2009-2012 and 14000 2013-2017. The federal estate tax exclusion is also climbing to more than 12 million per individual.

The amount an individual can gift to any person without filing a gift tax return has remained at 15000 since 2018. 2022 Annual Gift Tax and Estate Tax Exclusions Increase. Note also that for transfers that are deemed to skip a generation such as gifts to your grandchildren the GST tax exemption for 2022 is also inflation-adjusted to 12060000.

For 2022 the annual gift exclusion is being increased to 16000. The amount you can gift to any one person without filing a gift tax form is increasing to 16000 in 2022 the first increase since 2018. The federal estate tax exclusion is also climbing to.

The Gift Tax Annual Exclusion increased by 1000 in 2022. 2021 and 2022 gift and estate tax. The maximum rate of the federal estate tax is 40 percent so it can have a significant impact on your legacy.

The annual gift exclusion is applied to each donee. For example assume that in 2022 you give gifts totaling 16000 to each your three children for a total of 48000. As of November 10th the IRS has issued guidance for 2022.

11700000 DSUEA 1. Gifts to beneficiaries are eligible for the annual exclusion. There have been inflation adjustments each year since then and in 2022 the exclusion is 1206 million.

In addition the basic estate tax exclusion amount for the estates of decedents dying during calendar year 2022 will be 12060000 for individuals and. 159000 164000 Generation-skipping transfer GST tax exemption. In 2022 the annual gift tax exemption is increased to 16000 per beneficiary.

The estate and gift tax lifetime exemption amount is projected to increase to 12060000 currently 11700000 per individual. The new numbers essentially mean that wealthy taxpayers can transfer more to. The IRS has announced that the annual gift exclusion will rise to 16000 for calendar year 2022.

In addition in 2022 the gift tax annual exclusion amount for gifts to any person other than gifts of future interests to trusts will increase to 16000 while the gift tax annual exclusion amount for gifts to a non-citizen spouse will increase to 164000. Like the estate and gift tax exclusion amount the increased GST tax exemption amount is only available for transfers made after 2017 and before 2026. The annual exclusion for gifts increases to 16000 for calendar year 2022 up from 15000 for calendar year 2021.

Estates of decedents who die during 2022 have a basic exclusion amount of 12060000 up from a total of 11700000 for estates of decedents who died in 2021. For 2022 the annual exclusion is 16000 per person up from 15000 in 2021. The IRSs announcement that the annual gift exclusion will rise for calendar year 2022 means that any person who gives away 16000 or less to any one individual anyone other than their spouse does not have to report the gift or gifts to the IRS.

The IRS has announced that the annual gift exclusion will rise to 16000 for calendar year 2022. ANNUAL GIFT TAX EXCLUSION. If you and your spouse want to gift something that.

In 2022 the annual exclusion is 16000. 13 rows Annual Gift Tax Exclusion The IRS allows individuals to give away a specific amount of. The annual exclusion for gifts increases to 16000 for calendar year 2022 up from 15000 for calendar year 2021 httpswwwirsgovnewsroomirs-provides-tax-inflation-adjustments-for-tax-year-2022.

You could give any individual up to 15000 in 2021 without. In 2022 the gift tax annual exclusion increased to 16000 per recipient. 27 rows How the Annual Exclusion Works.

And the gift tax annual exclusion amount jumps to 16000 for 2022 up from 15000 where its been stuck since 2018. 12060000 DSUEA 1. Each year the IRS sets the annual gift tax exclusion which allows a taxpayer to give a certain amount in 2022 16000 per recipient tax-free without using up any of his or her lifetime gift and.

What per person per person means. Gifts of less than the annual gift exclusion are passed on tax-free while gifts over the exemption amount could be subject to the unified gift and estate tax. Gift and estate tax applicable exclusion amount.

It increased the exclusion from 549 million to 1118 million. The gift exclusion applies to each person an individual gives a gift to. According to the Wolters Kluwer projections in 2022 the gift tax annual exclusion amount will increase to 16000 currently 15000 per donee.

In 2018 2019 2020 and 2021 the annual exclusion is 15000. The right of withdrawal is generally limited to an amount equal to the applicable annual gift tax exclusion. This might be done in a single gift to each child or a series of gifts so long as the annual total to each child is not greater than.

That means you can give up to 16000 to as many recipients as you want without having to pay any gift tax.

Consumer Credit Application Form New 18 Credit Application Templates Free Google Docs Application Form Application Registration Form Sample

Annual Gift Tax And Estate Tax Exclusions Are Increasing In 2022

Insure Your Family Health With Cashless Benefits This Diwali Season Gift Your Family Good Health Fo Medical Health Insurance Health Family Health

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Budget Template Annual Budget Template Annual Will Be A Thing Of The Past And Here S Why Budget Template Budgeting Meeting Agenda Template

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Save 15 On Select Designer Series Papers Stampin Pretty Paper Egift Card

Historical Estate Tax Exemption Amounts And Tax Rates 2022

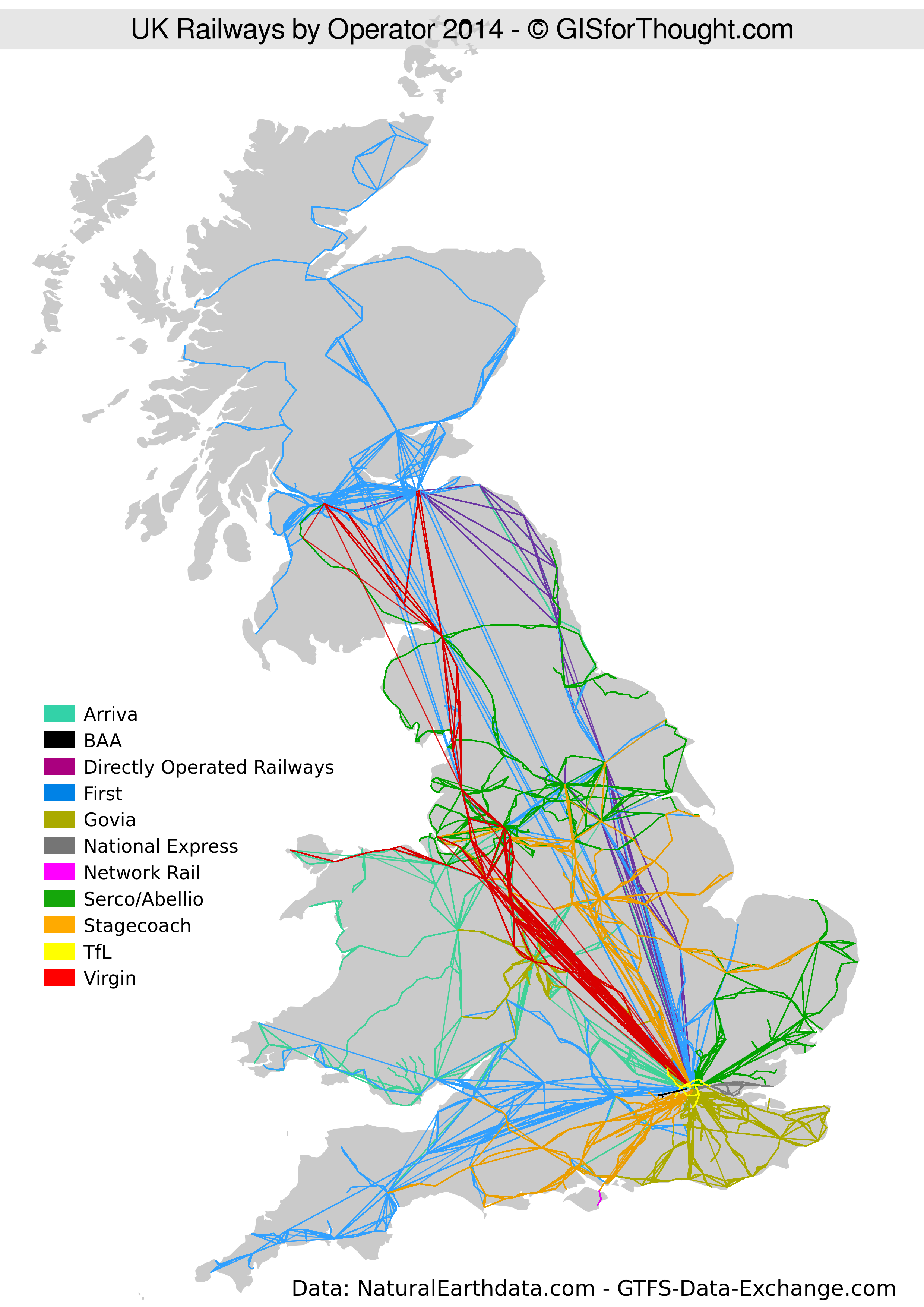

Uk Railway Network By Operator By Gisforthought Via Flickr Cartographer Map Diagram

Submitters Of Annual Wage Reports W 2 W 2c Must Complete The Submitter Ssa Page Of The Transmit Employment Application Money Making Hacks Accounting Firms

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

Projected Increases In 2022 For The Gift Tax Annual Exclusion Amount And Lifetime Exemption Preservation Family Wealth Protection Planning

Come Join Us Tomorrow For Our Annual Smokin Jack Vii Annual Whiskey Tasting Cigar Fundraiser Helping Local Cha Fundraiser Help Whiskey Tasting Local Charity

The 2022 Tax Deadlines In 2022 Tax Deadline Filing Taxes Tax Filing Deadline

Concentration Of Millennials In The Us Map United States Map Fun Facts

Irs Announces 2015 Estate And Gift Tax Limits Money Making Business Tax Deductions Estate Tax

Irs Announces 2015 Estate And Gift Tax Limits Money Making Business Tax Deductions Estate Tax